Market Insights

Opportunities

In the Tokyo property market opportunities for smart investments abound. It is after all the largest city in the world, with an extremely stable economy, government and employment, and solid real estate prices.

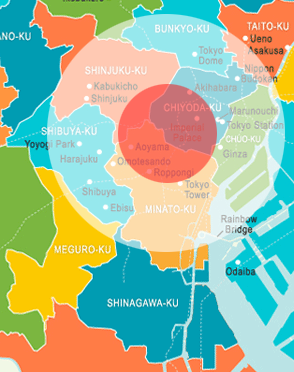

The size and stability of the real estate market offers opportunities for short-term and long-term gains for the savvy investor, seeking to diversify their portfolio. As an example, while the inner Tokyo area inside the circle of the Yamanote Line has long been characterized by high costs and long-term contracts, smaller and mid-size buildings outside the Yamanote circle provide easier entry into the market, and higher returns on investments in terms of rental income.

Leveraging our expertise, Hikari Homes can help international investors to define an investment profile that meets their specific investment and personal needs, whether it is short-term growth, long-term returns, or specific requirements for a second home.

First investment trends and recommendations

For new investors in the Japanese market, Hikari Homes believes second hand studio apartments offer the perfect introduction to the market. Tokyo city is still growing as more people shift to the city, creating demand pressure for accommodation. A more important trend is the growing number of single person households, with 42.5% of all people in Tokyo living alone in 2010, and as this figure continues to grow, the demand for smaller entry-level apartments continues to grow with it.

At the same time, depreciation on new buildings is very aggressive in Tokyo in the initial life of a building, so we recommend an older building that has absorbed this depreciation and is now reasonably priced and offer solid returns through rental.

Leveraging our expertise, Hikari Homes can help international investors to define an investment profile that meets their specific investment and personal needs, whether it is an entry-level studio apartment, short-term growth, long-term returns, or specific requirements for a second home.

A brief introduction to the Tokyo property market

The single largest determining factor for buying real estate in Tokyo is location, followed by the quality of quality and age of the building. It is the combination of the two that determine value, and the soundness of the investment. For example, an older building in a prime location may have considerable long-term value to redevelopers, while currently offering stable returns. A new building further from the city centre will offer better immediate cash flow, but lesser long-term growth expectations.

The single largest determining factor for buying real estate in Tokyo is location, followed by the quality of quality and age of the building. It is the combination of the two that determine value, and the soundness of the investment. For example, an older building in a prime location may have considerable long-term value to redevelopers, while currently offering stable returns. A new building further from the city centre will offer better immediate cash flow, but lesser long-term growth expectations.

For your reference, please visit Special Zone for Asian Headquarters web site by Headquarters of the Governor of Tokyo at;

http://www.chijihon.metro.tokyo.jp/ahq_project/index.html

Location

Location in Tokyo is critical in terms of prestige, and travel times, and the two are intimately connected. The most sought after and expensive areas are by and large close to the city centre, and have a very established infrastructure including proximity to stations, access to education, recreation, shopping and cultural facilities, and short travel times to all points within the city. More affordable areas are found outside the city centre, often defined as the area within the circle of the Yamanote Line.

Location in Tokyo is critical in terms of prestige, and travel times, and the two are intimately connected. The most sought after and expensive areas are by and large close to the city centre, and have a very established infrastructure including proximity to stations, access to education, recreation, shopping and cultural facilities, and short travel times to all points within the city. More affordable areas are found outside the city centre, often defined as the area within the circle of the Yamanote Line.

Building quality

The quality of the building is the second key consideration in any investment decision. For individual apartments and resident blocks, the type of construction and reputation of the construction company are paramount. The cut off age for older buildings is 1981, when a new building laws proscribing construction and earthquake proofing regulations were put in force, and all new buildings after this date meet these more stringent requirements.

The quality of the building is the second key consideration in any investment decision. For individual apartments and resident blocks, the type of construction and reputation of the construction company are paramount. The cut off age for older buildings is 1981, when a new building laws proscribing construction and earthquake proofing regulations were put in force, and all new buildings after this date meet these more stringent requirements.

Ticking these boxes gives liquidity to the investment, as they are seen as prerequisites for sale to a conservative Japanese buyer. Take on the mindset of the Japanese real estate buyer in terms of quality and value, and you minimize the risk in any investment.

About Us

About Us